Why Do We Love Ratings Participants?

The latest NuVoodoo Ratings Prospects Study again shows why we love ratings participants. We sifted through our latest sample of 2,979 persons 14-54 across all PPM markets to find the few who model through to be likely candidates for either ratings methodology. Yes, we know diaries are placed in only a handful of those PPM market counties where there are smaller, overlapping or embedded metros. Our goal is to dig into the psychographics who would either accept meters for their households (and the lengthy commitment involved) or one-week paper diaries (and their smaller compensation, but more active requirements).

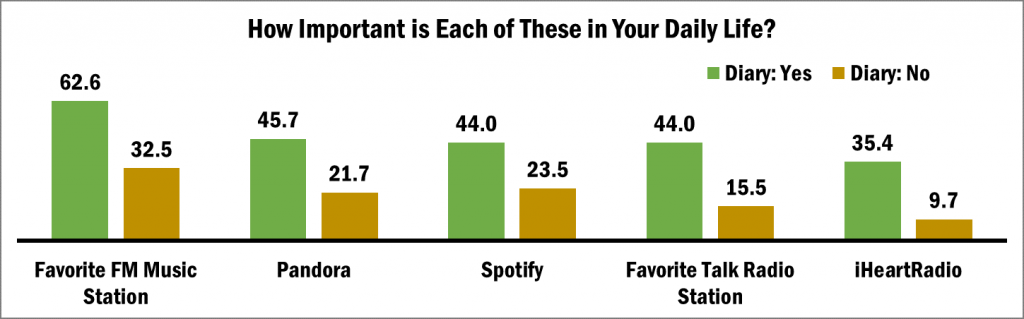

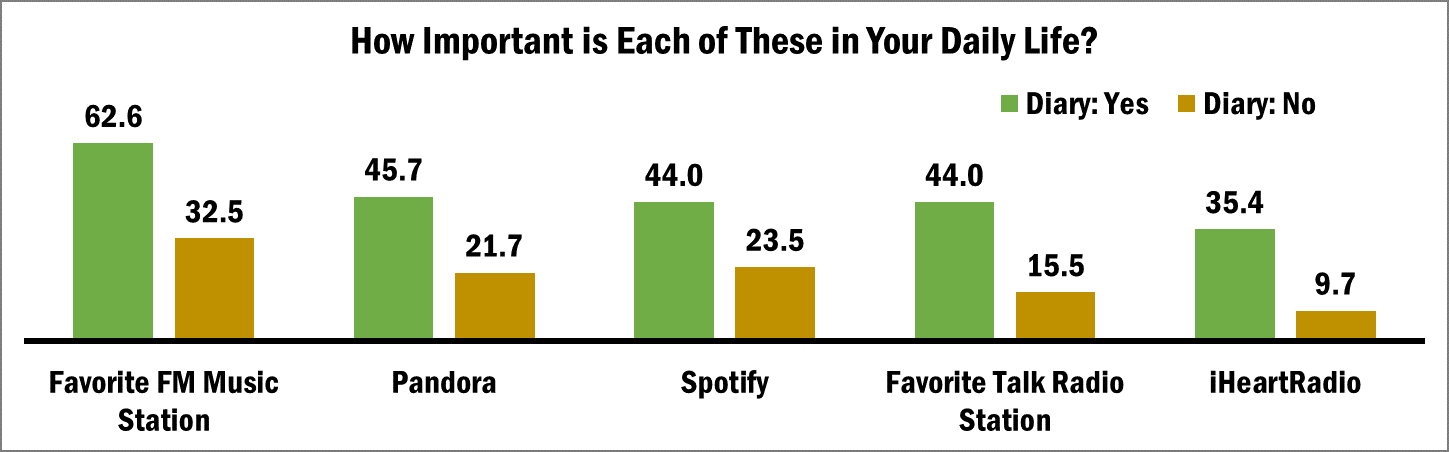

Respondents rated the importance of over a dozen different types of media in their daily lives on a 6-point scale in the interview. Looking at the top two-box responses for some of the media types shows the striking differences between the small groups who are likely to participate in the ratings and the majority of the sample who would not participate.

Among ratings likelies in either methodology, the percentages often at least double what we observe in the larger group unlikely to participate. And, these “radio-active” likely participants give huge importance numbers to FM music radio and strong numbers to spoken-word radio. Of course, Pandora and Spotify show up with the ratings-likely groups as well. These are, after all, people who really like listening to music and content.

iHeartRadio showed up with small importance numbers among the larger groups who aren’t likely to show up in ratings samples, but those numbers triple or quadruple among ratings likelies – with their higher terrestrial TSL, they’ve gotten greater exposure to promotion about the iHeart platform.

The full data that we’re sharing now with NuVoodoo clients shows the complete set of media and results as they vary by age groups. We’re also showing:

- Fresh numbers on Social Media engagement (which show some significant changes)

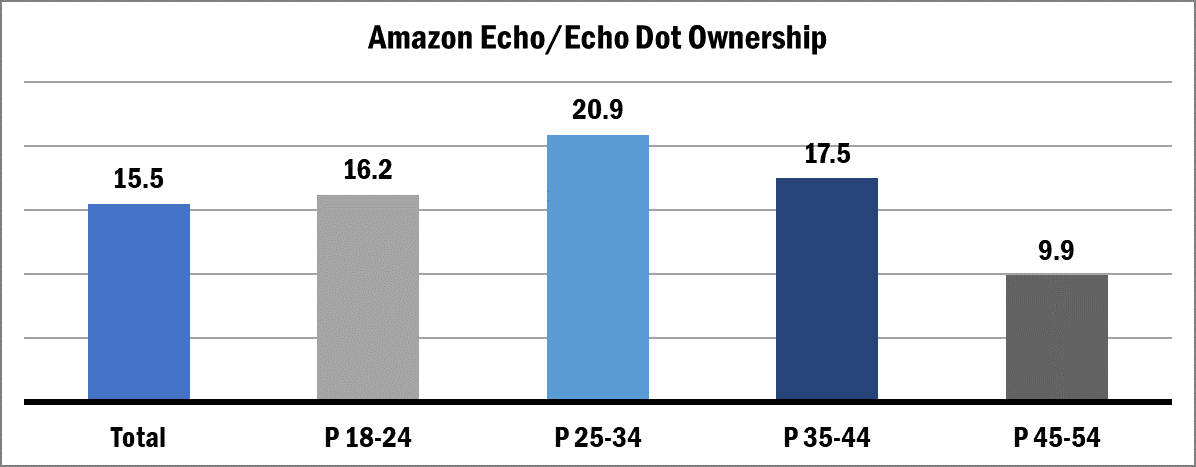

- Smart Speaker placement and usage (deeper info on which rooms they’re in and what content people are listening to on them)

- Tactics to increase TSL (beyond music quantity) and more

While broadcasters’ initiatives into digital-only content and distribution will be measured against the wider universe, over-the-air efforts continue to be measured against – and thus, have to be targeted at – ratings likelies. And so this latest study is the tenth NuVoodoo Ratings Prospects Study – in less than seven years. It’s the best way we know to stay current with rapidly-changing media and technological landscapes.