Reboot the Commute: In-Car Audio System Impact

Last week we released initial findings from NuVoodoo Ratings Prospects Study 18 showing increasing numbers of people expecting to resume their commute to work over the coming months. That’s good news for radio, since time spent commuting equals time spent listening to radio for many. Additionally, radio gets better usage and TSL among those working outside their homes than among those working from their homes. NuVoodoo is poised to help stations “Reboot the Commute” by sharing study results in webinars later this month. Reserve your spot at nuvoodoo.com/webinars.

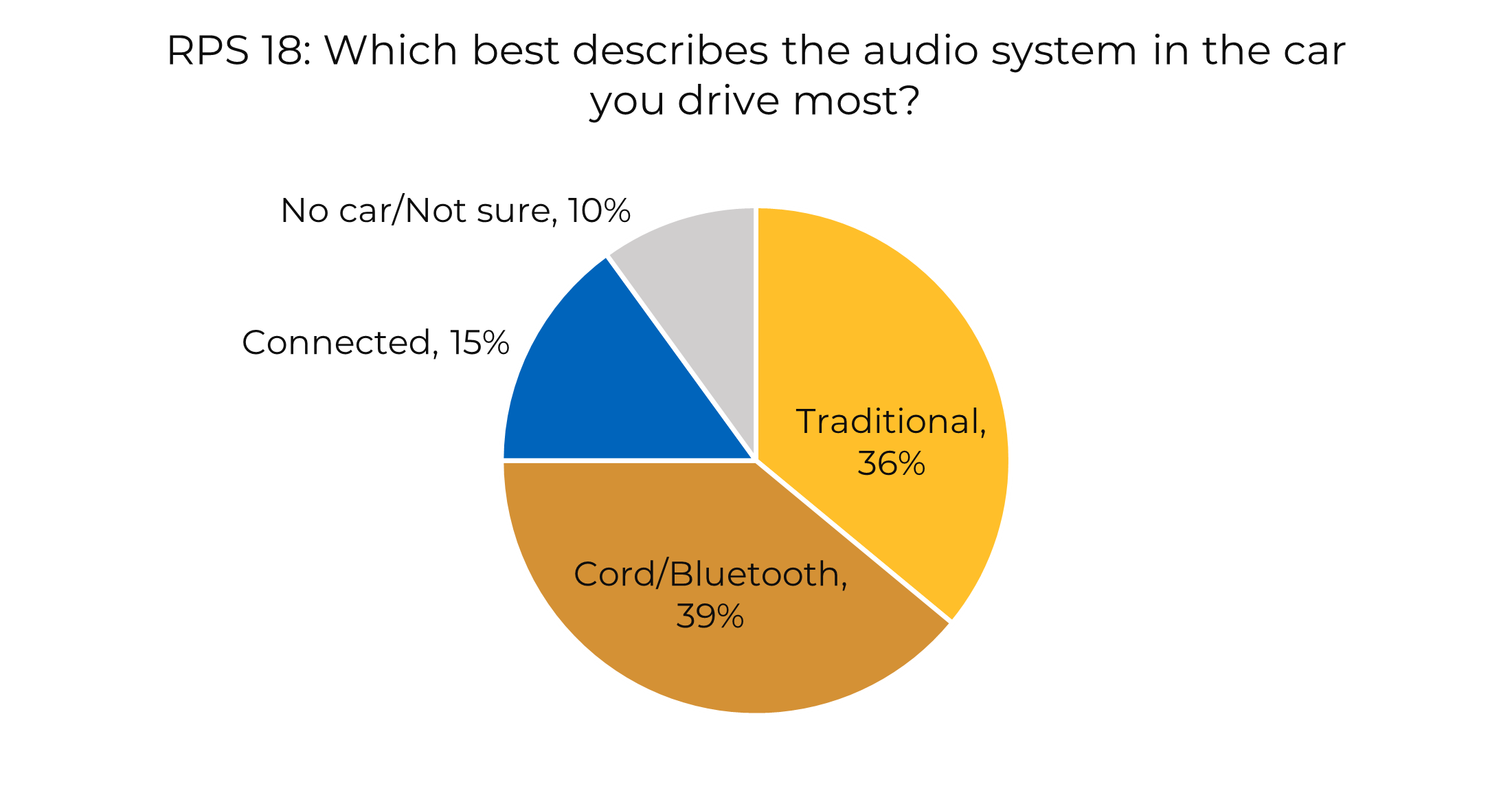

As people resume the commute to work, car audio will play a role in generating additional cume and AQH for radio. Our new data shows a correlation between broadcast radio usage and car audio systems. In our June study of over 3,000 respondents ages 14-54, starting from a broad list of car audio system descriptions, we broke down the systems into three buckets:

- “Traditional” car audio systems – older in-car audio systems with just FM/AM or those that add a CD or cassette player

- “Cord/Bluetooth” car audio systems – slightly newer systems with the provision to connect a smartphone or other audio device using Bluetooth or an auxiliary cord

- “Connected” car audio systems – the newest systems with icons for different sources already built in, or systems with Apple CarPlay or Android Auto

A 39% plurality of our sample fell into the transitional “Cord/Bluetooth” category; many in this category use the capability to connect a smartphone on rare occasions and listen mostly to broadcast radio (and sometimes built-in satellite radio). 36% classified as “Traditional” car audio system users, where radio rules the roost. For now, just 15% falls into the “Connected” car category. This last category puts DSP’s on a level playing field with broadcast radio – sometimes making it easier to navigate to offerings from DSP’s than tune to new radio stations.

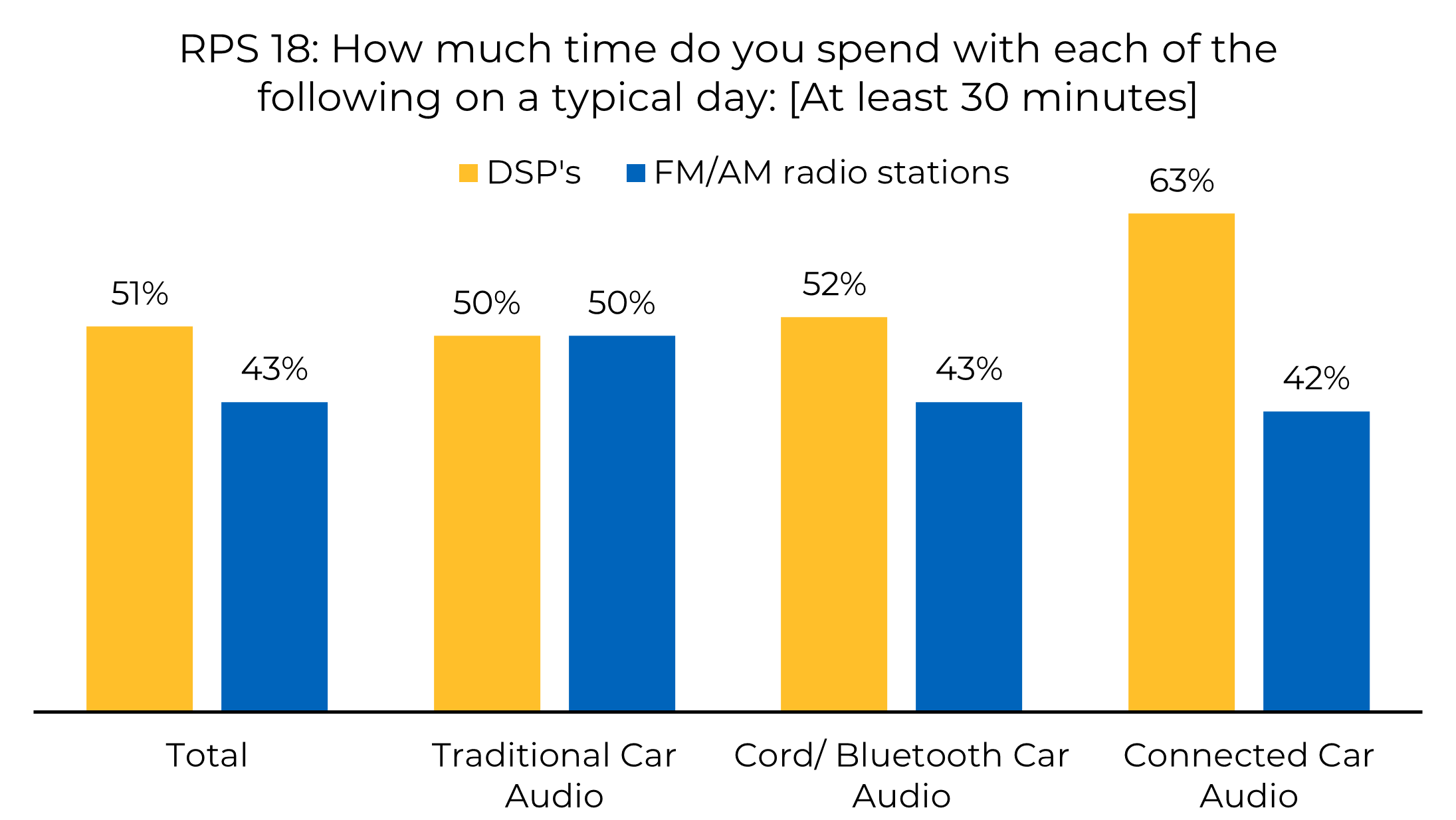

Percentages using broadcast radio versus DSP’s (Digital Streaming Providers: Spotify, Apple Music, Pandora, Amazon Music, etc.) at least 30 minutes per day vary with the in-car audio system being used. The easier it is to connect with DSP’s in the car, the more likely people are to use them.

Thirty minutes at any point – in any place – in a day is a relatively low bar chosen to show the differences in overall audio entertainment usage across users of different types of car audio systems. The small percentage (15%, for now) with “Connected” car systems are much more likely spend time with DSP’s. We’ll drill down into the results by demos, format affinities and ratings likelies in our webinar.

Reserve your spot for our webinar. Pick the day and time most convenient for you:

- Wednesday, July 21 at 1 PM EDT

- Tuesday, July 27 at 12 Noon EDT

- Thursday, July 29 at 2 PM EDT

- Wednesday, August 4 at 3 PM EDT

Topics include:

- Smart speakers, streaming and podcasts

- Most-used social and digital channels, including an update on OTT (Over the Top) video

- Where likely ratings participants notice radio station marketing campaigns

- Tune-in catalysts: what actually causes listeners to switch or listen more

- National and local contest mechanisms and prizes

- What drives those willing to wear a meter or fill out a diary

- A deep dive on ratings likelies who listen to the radio for an hour or more each day: this small fraction of the overall audience is what makes or breaks station ratings

In less than 45 minutes, we’ll cover topics essential to radio for capitalizing on rising PUMM and PUR levels and leveraging increased average quarter hour ratings. And we’ll stay on as long as necessary to answer all your questions.