ICYMI: VoodooVision

Throughout March we’ve been conducting webinars showing off the results of the latest NuVoodoo study. If you missed the webinars live, you can find a recording at nuvoodoo.com/webinars. We did our best to balance the interests of our newest clients outside the radio business with the needs of our longtime radio clients in the webinar.

While the study was our 21st large-scale study of audio media usage, it was our first sample to encompass the entire US. Previous samples have focused on only the Nielsen PPM markets. As explanation for those outside the radio business, the “PPM markets” are essentially the top 50 US markets, measured using Nielsen’s personal meter technology (smaller markets are measured by Nielsen using diaries in which respondents are asked to note their listening).

While our previous studies have tipped the scales at 3,500+ respondents, this latest sample from the start of 2023 encompasses 5,327 respondents aged 14-54. It includes the entire generation known as Millennials, the Gen Zs starting at age 14 (we need parental permission to interview younger than that), and Gen Xs up to age 54 (though they extend several more years).

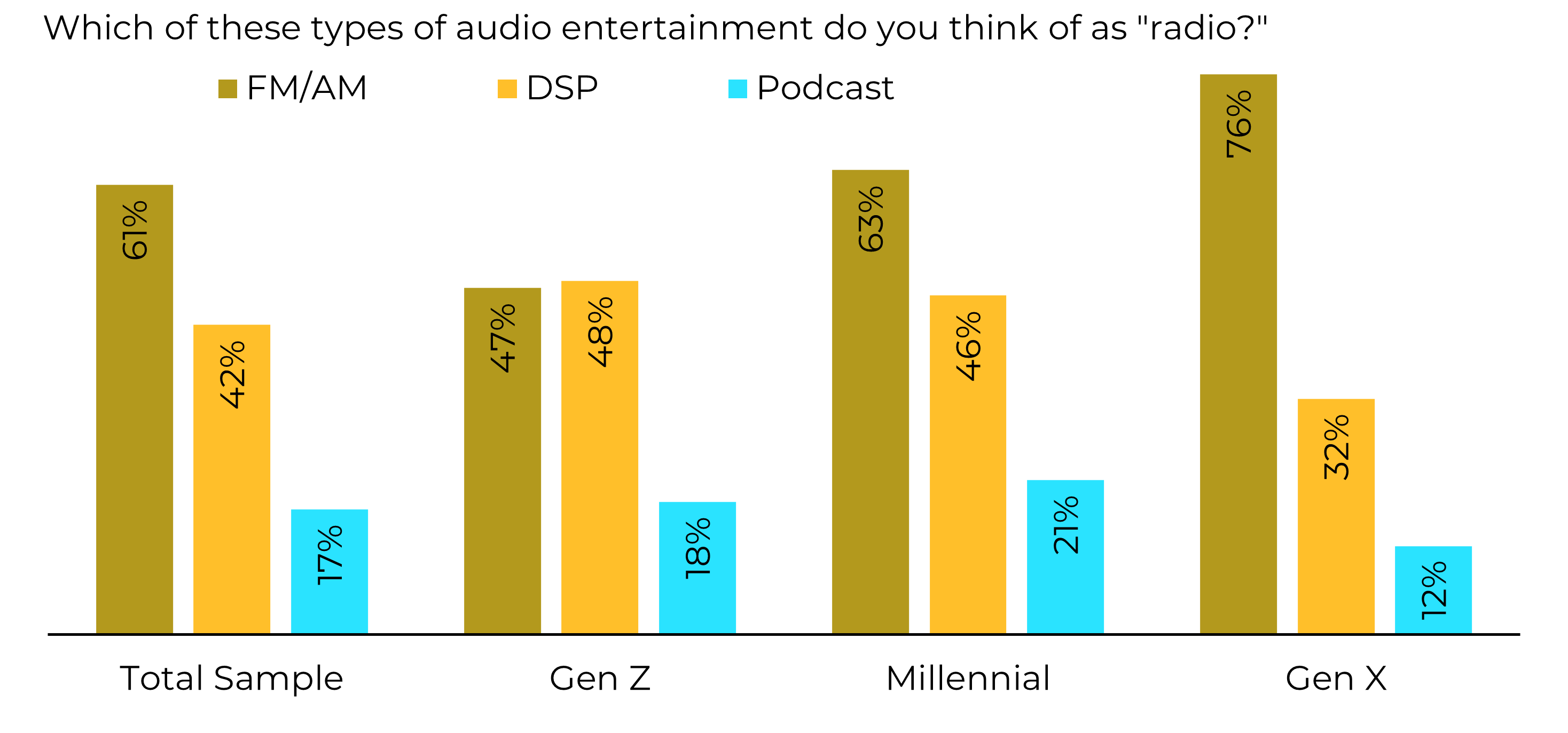

TV executives were displeased when consumers included Netflix in what they think of as “TV,” and consumers are now likely to include several times of audio entertainment in what they think of as “radio.” As shown below, Gen Z (ages 14-26) are as likely to think of DSPs (Digital Streaming Providers is the shorthand here, but respondents were given a description about audio apps including Spotify, Apple Music, Pandora, etc.) as “radio” as they are to think of broadcast radio on FM or AM.

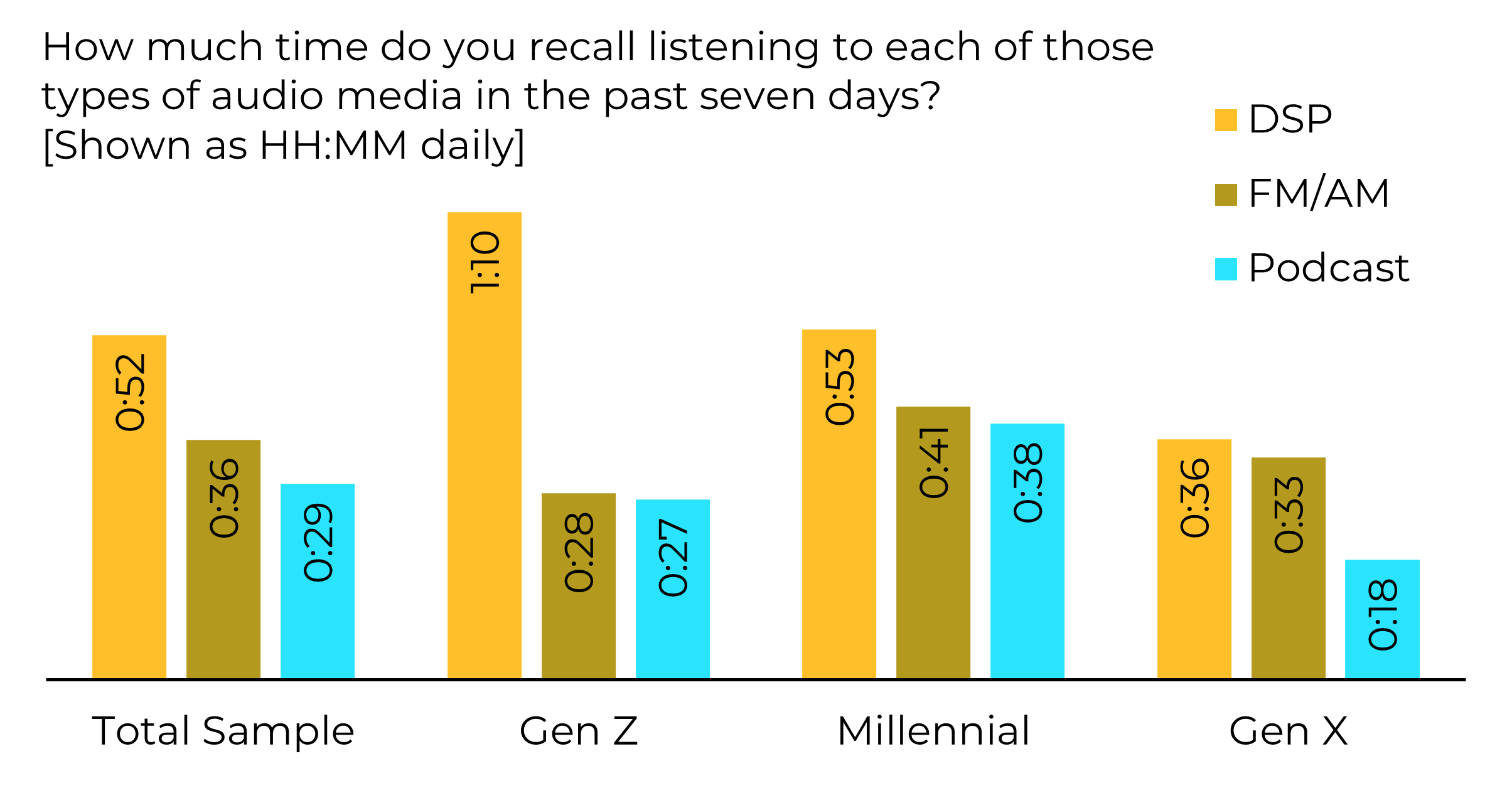

And that definition of “radio” for a new generation that could include DSPs like Spotify, Apple Music, Pandora, etc. shows up in the daily audio usage for these Gen Zs. The sort of monster TSL that broadcast radio had gotten from prior generations of young people is now going to DSPs, where Gen Zs are spending over an hour a day on average. Broadcast radio shows up substantially lower among Gen Zs than among Millennials. Meanwhile, broadcast radio is looking weaker than expected among the Gen X segment here, who’ve been great consumers of radio for many years.

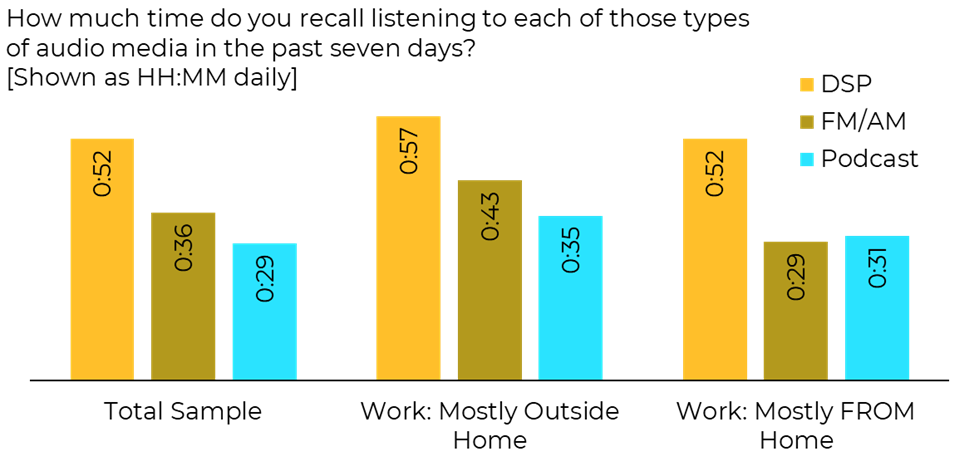

Broadcast radio does get an overall boost in usage among those who are back to work outside their home – jumping from 36 minutes per day to radio across the entire sample, up to 43 minutes per day. Both DSP listening and podcast listening get a boost among those working outside their homes. Meanwhile, the remaining work-from-home crowd benefits no audio media significantly and punishes broadcast radio, taking back the 7-minute gain shown among those working out of home.

With newer “connected” vehicles still a small minority in the national fleet represented in our sample, broadcast radio gets a boost among those driving cars and trucks with older audio systems. But broadcast radio can anticipate headwinds as the fleet changes – even before the announced phase outs of AM radio reception in Ford vehicles. Now there’s a strong incentive to work with dealers to get your app preinstalled in the vehicles they’re delivering.

We have a more radio-focused version of the webinar that we’ve been sharing in meetings with clients and prospects. If you’d like to arrange a session, please reach out to us at tellmemore@nuvoodoo.com and we’ll get you on the calendar.