New Marketing Tool: OTT-TV

The final livestream of the latest NuVoodoo webinar is Monday, February 22 at Noon Pacific. It includes our latest data on: Smart speakers, national and local contests, marketing messages, social media, advertising channels, podcasts & streaming and more. We cover the information in less than 40 minutes and stay on as long as needed to answer questions. Register at nuvoodoo.com/webinars.

Talking about marketing tactics in the webinar, NuVoodoo marketing guru Mike O’Connor reviews a new tactic that’s helping our clients play the Nielsen game successfully – despite the battlefield shifting dramatically. With many working from home, we’ve dedicated more of our clients’ budgets to reaching listeners AT HOME.

As far back as this past summer, Mike and our marketing team started seeing TV screens becoming a significant placement for YouTube ads. One particular YouTube metric really stood out: the conversion to video views lasting 30 seconds or longer. In the world of digital video, 30 seconds is an eternity. That was an initial indication of the upshift in the time spent watching OTT-TV content.

OTT stands for “over the top” and refers to streaming media offered directly to viewers via the internet. OTT-TV bypasses cable, broadcast, and satellite television platforms and is accessed on personal computers, apps on mobile devices (such as smartphones and tablets), digital media players (including video game consoles), integrated Smart TV’s or TV’s connected to the internet through devices like Roku, Google Chromecast, etc.

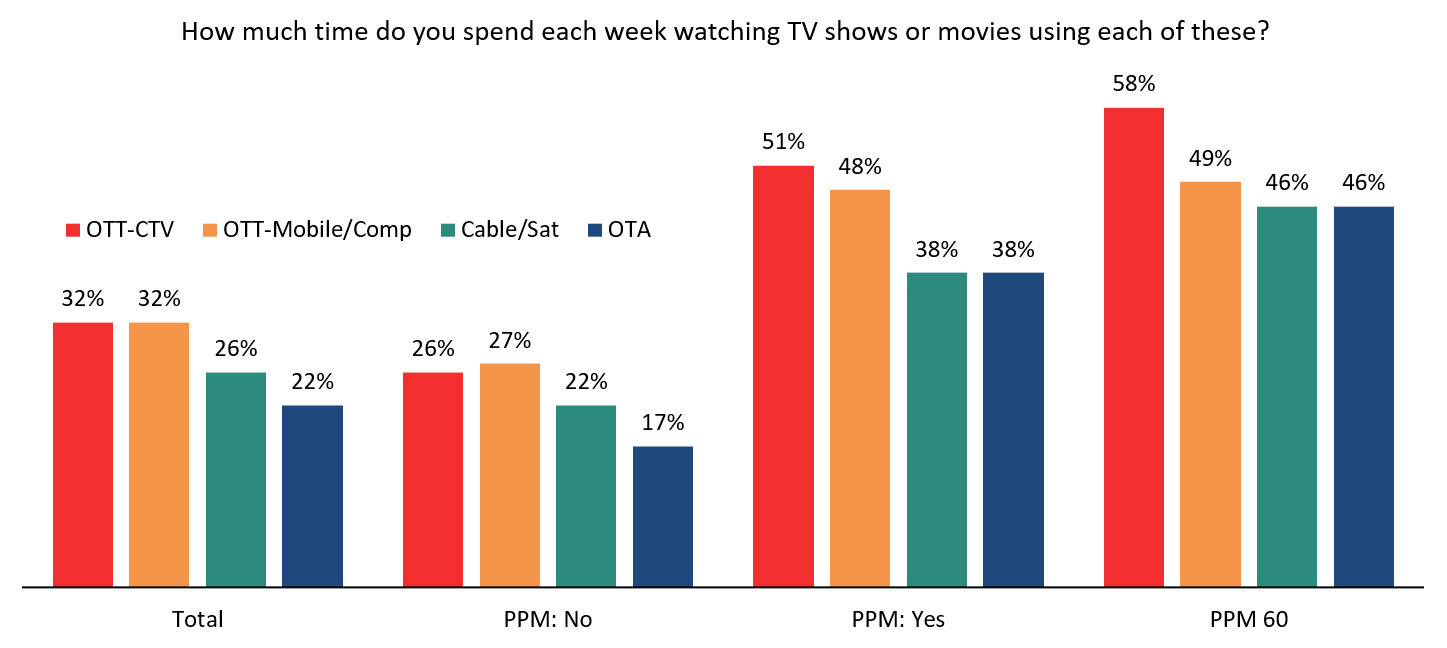

First we wanted to know if the reach in OTT-TV is big enough to justify expenditures. We also wanted to know if those likely to participate in PPM ratings are watching OTT-TV at a more significant rate than the majority who would never carry a meter. So, late in 2020 we fielded over 3,400 interviews across all PPM markets and learned that there’s a tsunami of viewing going on.

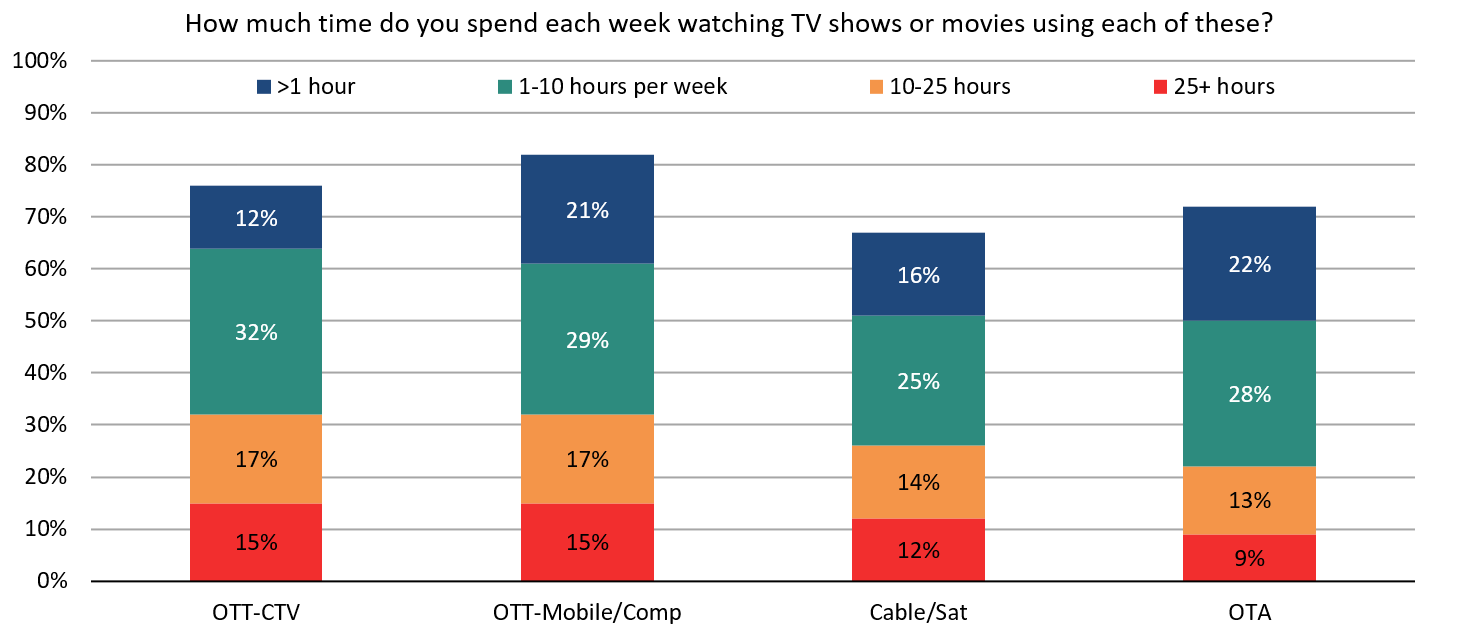

We split OTT-TV into two buckets: those watching OTT on Smart TV’s and connected devices like Roku, Google Chromecast, etc. (labeled OTT-CTV) AND those watching OTT on smartphones, tablets or computers (labeled OTT-Mobile/Comp). Groups of just under 1/3 apiece are spending 10+ hours per week with OTT in both modes.

This is a BIG change. We watched years ago as Emmy nominations drifted from broadcast networks to premium cable channels … and now we watch as they drift from premium cable channels to Netflix, Hulu, Disney+ and on and on. You can see that the groups spending 10+ hours a week with Cable or Satellite TV or Broadcast are smaller – about a quarter for Cable/Satellite and a fifth for OTA (over the air).

Among the PPM likelies we’ve identified using the proprietary questions we’ve developed to mimic the process of empaneling respondents (labeled “PPM Yes”), about 50% apiece are viewing 10+ hours a week using either OTT/Connected TV or OTT content on a non-TV device. Those are BIG numbers compared to the overall sample (or the large subset of the sample who would reject the opportunity to carry a meter – the PPM No’s here). Also, notice the columns labeled PPM 60; that’s the subset of our PPM Yes group who say they listen to broadcast radio at least an hour – sixty minutes – per day.

Mike and the NuVoodoo marketing team use third-party targeting from the Nielsen marketing cloud to reach the most likely ratings respondents and give us the ability to deliver OTT-TV impressions based on heavy format and daypart listening. The result is a cost-efficient mix of TV impressions across the spectrum of devices to keep budgets reasonable. We’ll cover this information in detail during the webinar or you can learn more in this short video.