NuVoodoo Ratings Prospects Study 19 Preview

We’re getting ready to present NuVoodoo Ratings Prospects Study 19 on Wednesday, February 16 at 1 PM ET/10 AM PT. You can reserve your spot for the free webinar at nuvoodoo.com/webinars.

We’ll be maintaining our focus on the type of person likely to say “yes” to Nielsen; we refer to these respondents as “RPS Yes.” Knowing what makes people likely to become a panelist or diary keeper helps guide you to efficiently find them and choose tactics to influence their listening. Find more information in a new video.

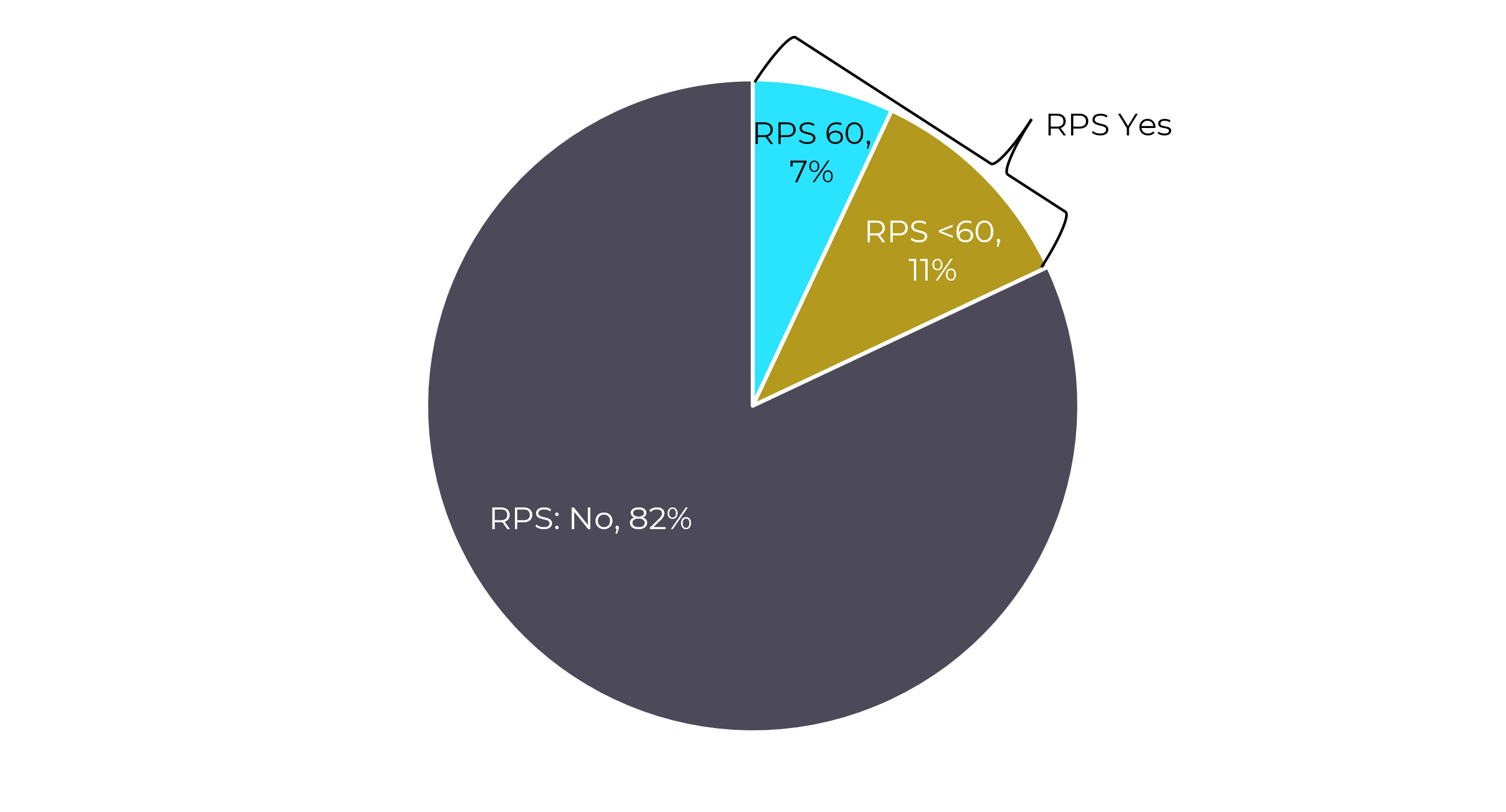

In our new data, RPS Yes respondents drop slightly to 18% of all study participants, down a point from our previous study in June 2021. Even more important is the subset of that group who spend at least an hour each day listening to radio, we refer to them as “RPS 60” listeners. With their massive TSL, the RPS 60 segment is instrumental in determining ratings outcomes. In our new data this heavy-listening RPS 60 segment holds steady at 7%.

Unlike the overall population, any research sample is inherently survey friendly. Every one of our online respondents is compensated for their participation. Even so, when we describe what’s involved in becoming a ratings participant, better than eight in ten want no part of it – they’re classified here as “RPS No.”

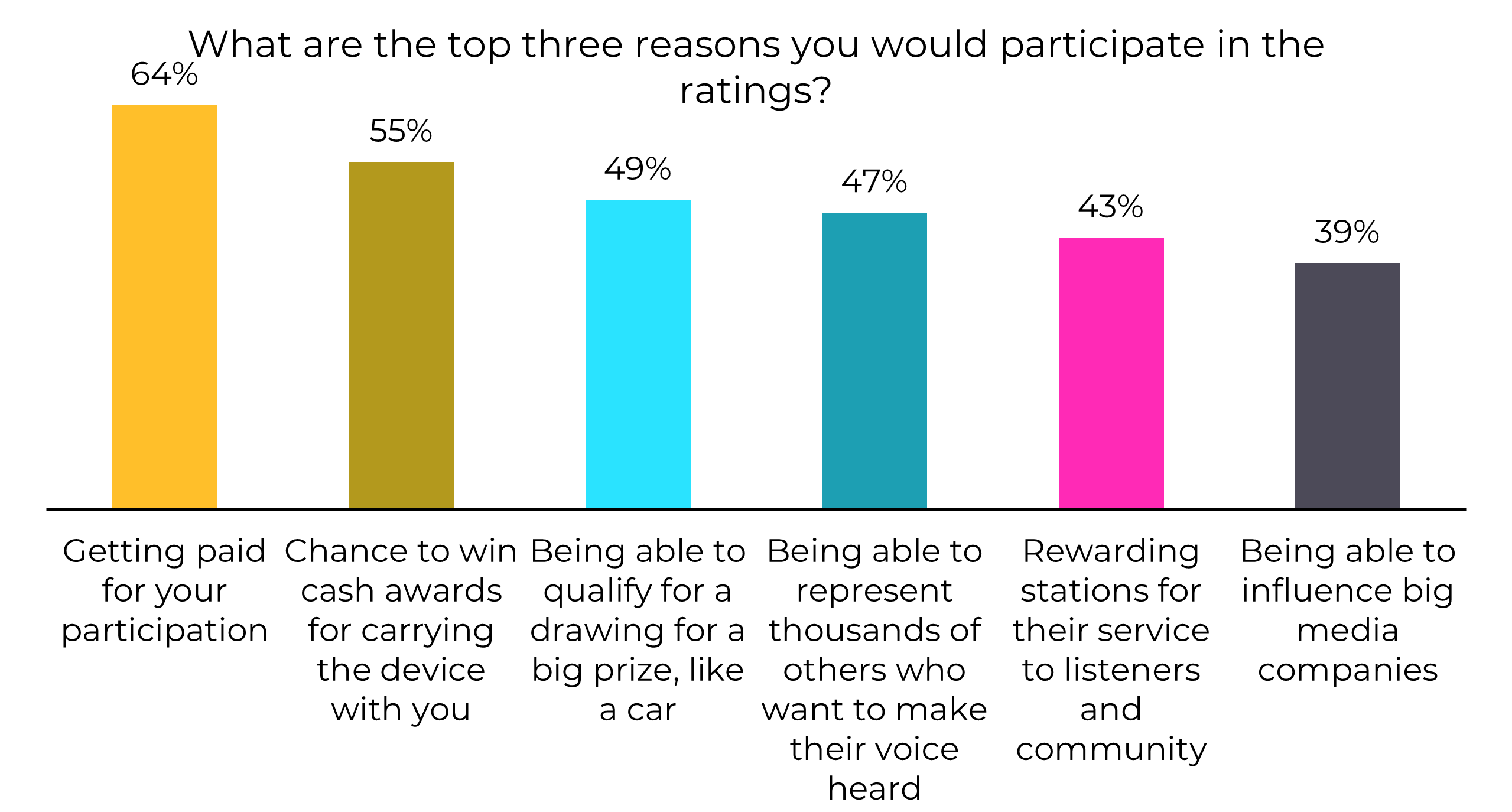

So, why DO ratings prospects say ”yes” to Nielsen? It’s a four-letter word: C-A-S-H. That’s the reason why station contests remain a primary promotional tool for radio. Money and prizes are how panelists and diary keepers are incentivized to be a part of the ratings sample.

Cash rewards and big prizes outrank altruistic intangibles like giving voice to others or rewarding stations for community service. Nielsen not only thanks participants with money, they also incentivize compliance with prizes. In PPM markets, panelists have their own contest platform and they’re entered to win for meeting daily and weekly requirements.

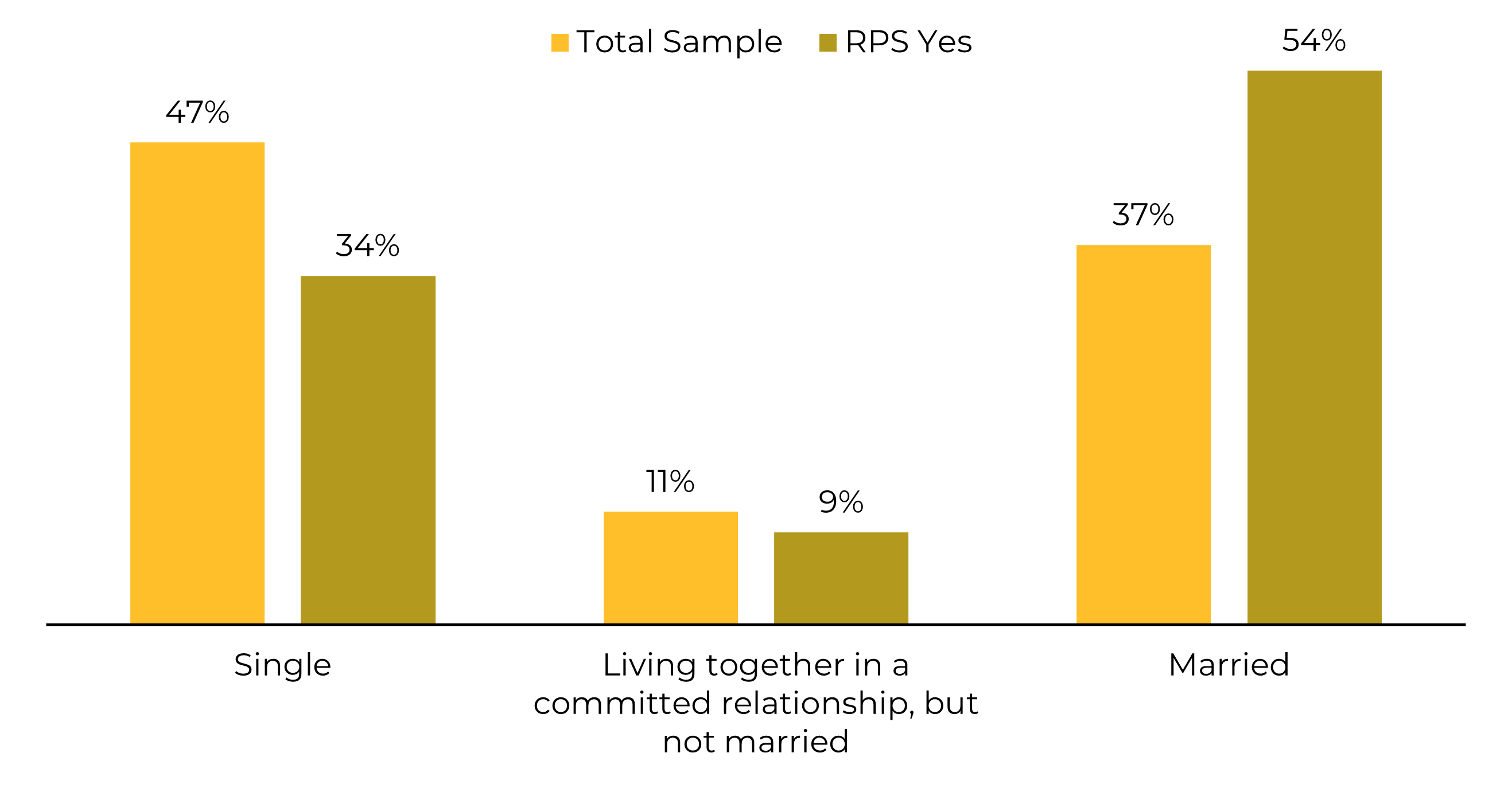

And while ratings samples ARE weighted for gender, age and ethnicity, there are many other characteristics for which they are not controlled. Marital status for one. The chart below shows that singles are significantly under-represented as likely ratings respondents: just 34% of RPS Yes respondents are single, compared to 47% across the total sample. Married couples meanwhile overindex as ratings prospects by a wide margin: 54% of RPS Yes respondents are married, but it’s only 37% across our total sample.

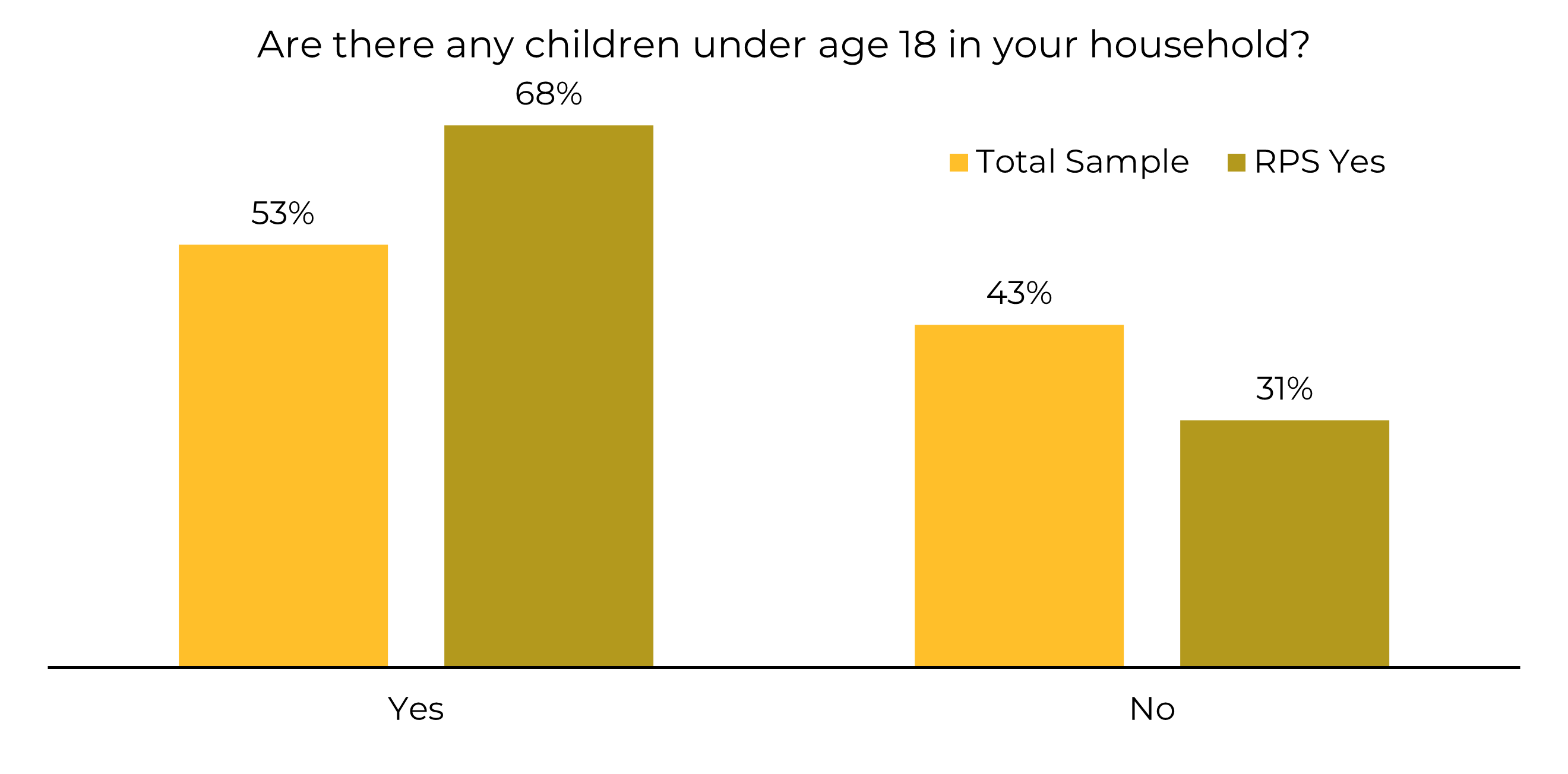

RPS Yes respondents are also more likely to have kids at home. In fact, there’s a 15-point gap when we compare RPS Yes respondents with kids at home to the kids-at-home composition across our total sample: 68% of ratings prospects vs. 53% in the total sample.

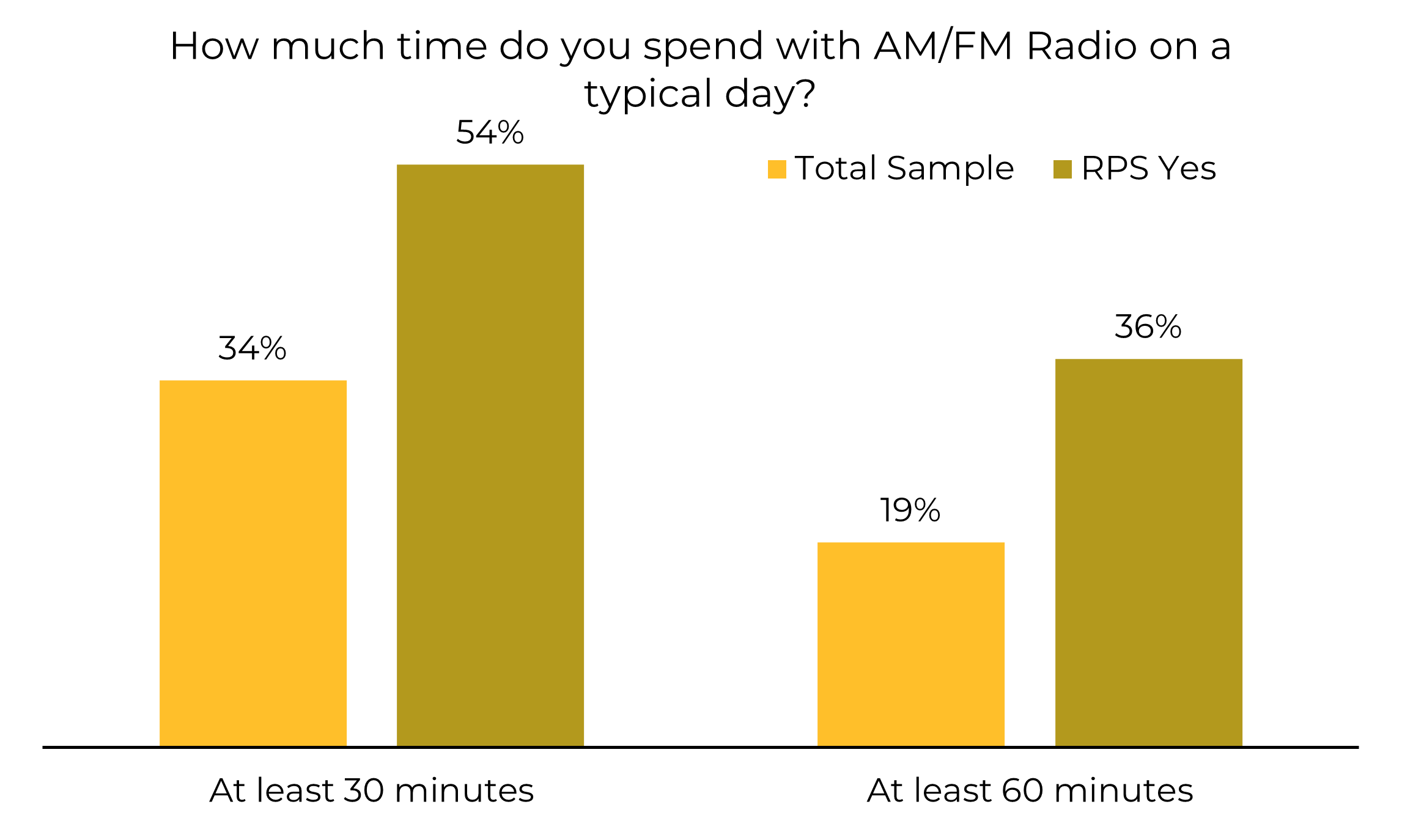

But ratings prospects are good for radio – they listen more than others. While only a third in our total sample listen to radio for at least 30 minutes each day, it’s more than half of RPS Yes respondents.

And when we raise the bar to at least an hour’s listening per day, it’s slightly less than one in five across our total sample, but almost double that among the RPS ratings likelies. These hour-plus-per-day likely ratings respondents are the ones we label RPS 60’s. They comprise just 7% of the sample, but their opinions really matter.

The NuVoodoo Ratings Prospects Study 19 free webinar is February 16 at 1 PM EST, 10 AM PST. Go to nuvoodoo.com/webinars to reserve your spot. In less than 40 minutes, we’ll cover a lot of ground:

- For years, we’ve looked at tune-in catalysts. Now, for the first time, we’ve tested an extensive list of potential tune-out catalysts. We’ll share what radio stations do that drives listeners away.

- We’ll look at work-from-home and listen-at-work (out of home) trends and compare the impact on radio station TSL.

- How often listeners use streaming apps, from Spotify, Apple, and Amazon to Soundcloud, Tune-in, and iHeart. We’ll see how well local AM/FM radio streaming apps fare by comparison.

- Deep dives into Smart Speakers, Car Audio Systems and Podcast listening trends.

- Daily and chronic use of social media apps. Given recent news, we also asked listeners to share any psychological toll that using social media is taking on them – and what compels them to use certain apps so much.

- We’ll compare and trend the lure of typical radio station cash offers and contest packaging tactics. Plus, we’ll share some practical steps radio stations can take to battle the perception that sweepstakes are not on-the-level.

- We’ll look at radio station marketing strategies, including social media, connected TV, direct mail, outdoor, and telemarketing, and show you which have caused listeners to tune in and listen more.

Join us Wednesday, February 16th at 1 PM EST, 10 AM PST for NuVoodoo Ratings Prospects Study 19. You can register here.