Advertising Effectiveness Part 1: Where Consumers Engage Most With Your Advertising Message

In this series, we’re sharing newly captured consumer data measuring advertising engagement rates across demographics for nearly two dozen ad channels. In Part 1, we’ll take you through a deep dive into NuVoodoo’s study data. Then in Part 2, we’ll follow up with two case studies – examples of how the NuVoodoo digital marketing team helps clients take action on our research insights, converting opportunity into implementation.

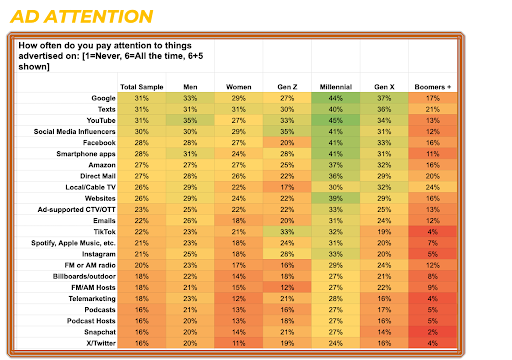

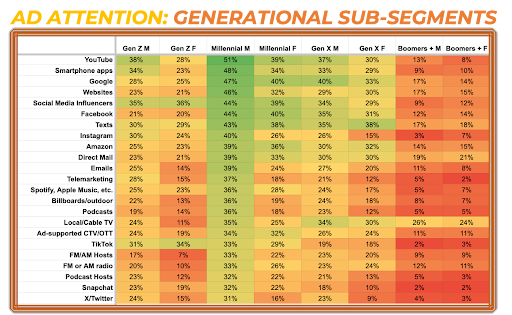

In today’s micro-fragmented media environment, capturing consumer attention has become a moving target. With a multitude of ad channels and platforms competing for engagement, marketers must make data-driven decisions to maximize effectiveness. To uncover where audiences truly focus their attention, NuVoodoo conducted a comprehensive study analyzing advertising attention rates across demographics and platforms. By evaluating responses from over 2,900 consumers, we identified key trends in advertising receptivity, breaking down how different generations of consumers interact with digital, social, and traditional ad channels. The findings reveal not only where brands should prioritize their ad spend but also the shifting behaviors of various age groups in an increasingly video-dominated landscape.

Understanding the Study: Methodology and Sampling

To determine where consumers pay the most attention to advertising, NuVoodoo conducted a nationwide study in Q1 2025, surveying 2,908 respondents aged 14 and older about their media habits. The objective? To identify the optimal advertising platforms and channels by measuring consumer engagement on a 1-to-6 scale—with 5+6 (“often” or “always” paying attention) serving as the key indicator.

Overall Trends in Advertising Engagement

Several clear trends emerged across all generations:

✅ YouTube and Google lead the way in ad attention across all age groups, though Boomer engagement drops significantly.

✅ Text messaging (SMS ads) remains a top performer, particularly among Millennials and Gen X.

✅ Social Media Influencers attract strong engagement among Gen Z and Millennials, but their influence declines with older demographics.

✅ Facebook remains strong among Millennials, Gen X, and Boomers, but Gen Z largely ignores it.

✅ Boomers (and beyond) respond more to traditional channels, including direct mail and Amazon ads.

Common Threads Across Generations and Demographics

By analyzing Gen Z (13-27), Millennials (28-43), and Gen X (44-59), both male and female, several shared trends stand out:

✅ YouTube and Google remain dominant across all groups.

- YouTube ranks as the top ad platform for men in each generation: 51% of Millennial men, 39% of Gen X men, and 38% of Gen Z men.

- Google also maintains high engagement, though slightly lower among Gen Z.

✅ SMS ads are effective across all demographics.

- Millennial men (47%) and women (43%) pay the most attention to text-based advertising.

- Gen X men (38%) and Gen Z men (30%) also engage with SMS ads more than expected.

✅ Social Media Influencers hold multi-generational appeal.

- Ranks in the top 5 for Gen Z and Millennials.

- Gen X men (34%) engage with influencers even more than Gen Z women (28%).

✅ Smartphone App ads are highly effective.

- Millennial and Gen Z men show the highest engagement (40%+).

- Gen X men (34%) also engage significantly, while Gen X women (29%) show lower attention.

Key Differences Between Generations and Gender Segments

🚨 Millennial men are the most ad-receptive group overall.

- Highest engagement across platforms (40%+ on YouTube, Google, SMS, and with social media Influencers).

- Ad-supported CTV/OTT (streaming TV) breaks 40% with this group (46%).

🚨 Gen Z men engage heavily with TikTok & Influencers, but Gen Z women less so.

- TikTok: 31% engagement for Gen Z men, but only 24% for Gen Z women.

- Influencers: 35% for Gen Z men vs. 28% for Gen Z women.

🚨 Gen X men still engage with Facebook ads, while Gen Z does not.

- Gen X men (35%) pay nearly double the attention of Gen Z men (21%) and women (20%).

🚨 Millennial women engage less with YouTube ads than Millennial men.

- YouTube ranks #1 for Millennial men (51%) but only 39% for Millennial women.

🚨 Gen X men are more engaged than expected across digital ad channels.

- YouTube (39%), Google (40%), and SMS ads (38%) engagement nearly matches Millennials.

- More engagement with Influencers (34%) than Gen Z women (28%).

At NuVoodoo, we don’t just observe consumer behavior—we measure it and turn insights into actionable strategies that drive real results. In Part 2 of the series, we’ll take you through two case studies for how clients might implement what our data reveals. The first marketing project targets Gen Z Women, while the second campaign is geared toward Millennial Men. Subscribe at www.nuvoodoo.com and we’ll email the follow-up directly to your inbox.

From capturing key consumer insights and comparing platform effectiveness to crafting data-driven media plans and compelling creative narratives, we guide our partners every step of the way. With decades of experience in research, analytics, and campaign implementation, we translate complex metrics into high-performance marketing solutions that deliver. Ready to optimize your advertising strategy? Contact us at tellmemore@nuvoodoo.com—let’s turn strategy into action.