The Digital Habits of Higher Income Households – Part 1

Over the next several articles, we’re going to take a look at the digital media habits of a consumer segment that advertisers and brands covet most – households with high levels of discretionary spending potential. In NuVoodoo’s recently completed 2025 media study, high-income ($100K to $199K) and very high-income households ($200K or more) together account for 18% of our total sample of 2,908 nationwide respondents, with the $100k income tier outnumbering the higher $200K+ income group by a factor of three. It’s important to note that respondents were asked to report household income, not personal earnings—meaning a small number of young adults and teens living in higher-earning homes are likely included in this segment, even if they’re not the primary household breadwinners themselves.

🎯 Premium Households, Premium Attention: Where $100K+ Consumers Are Spending More Time

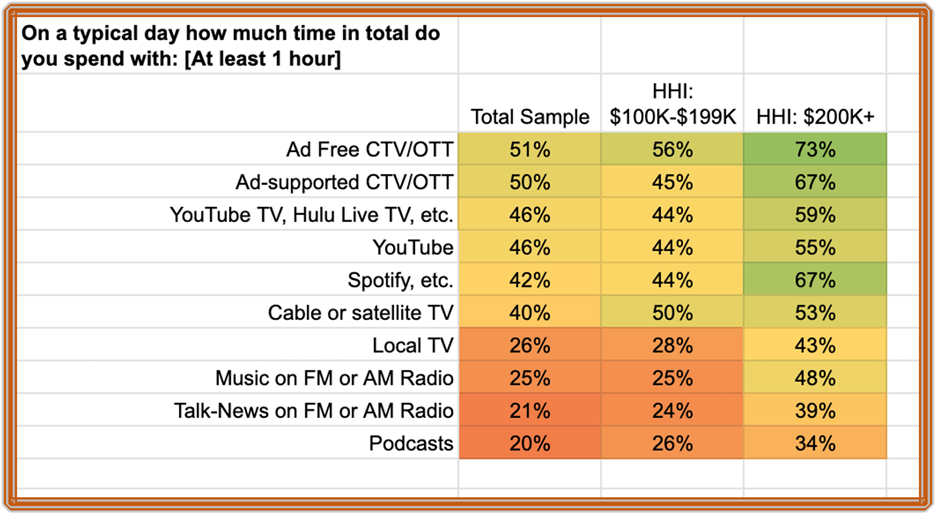

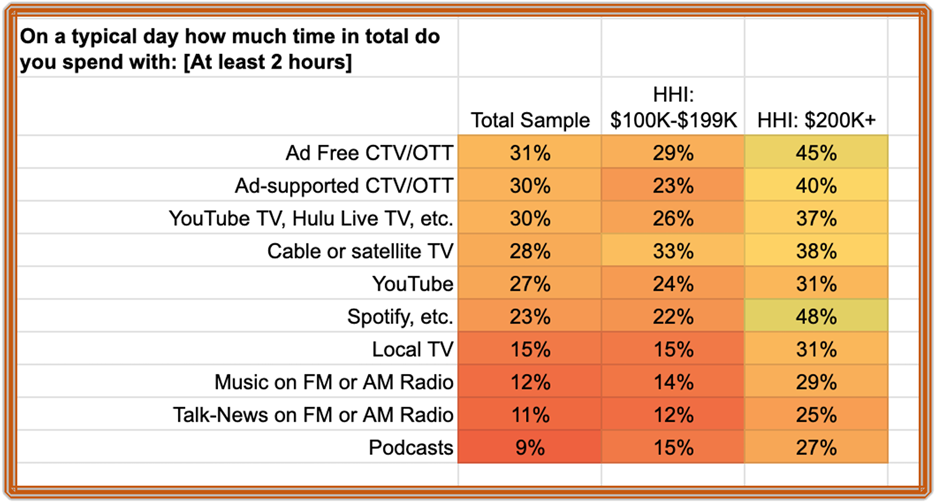

Across nearly every media category, high-income ($100K–$199K) and very high-income ($200K+) households consistently outpace the broader respondent population in daily media engagement — and the trend intensifies as income rises. For brands and advertisers, this reveals target-rich environments to reach more attentive, more affluent audiences across both digital and legacy platforms.

📶 1+ Hour Daily Use: Streaming, Audio, and Podcasts Lead the Way

- Ad-Free streaming video (i.e.: CTV/OTT) is the clear standout:

- 73% of $200K+ households watch at least an hour daily

- That’s a 22-point increase over the total sample (51%), and 17 points above the $100K–$199K tier

- But Ad-Supported CTV/OTT holds up strongly:

- 67% of very high-income households engage for 1+ hour per day. That’s 17 points higher than the general respondent pool

- Interestingly, the $100K–$199K group trails here (45%), suggesting room for brands to expand reach in an underleveraged segment.

- YouTube earns its place as a complementary streaming video platform, with significant outperformance in the highest income group.

- Streaming audio platforms like Spotify show major gains with affluence:

- 67% of $200K+ households listen an hour or more, vs. 42% among all respondents

- That’s a 60% lift in reach among the most affluent homes

- Podcasts follow a similar arc, with 34% of $200K+ homes listening for at least an hour, compared to just 20% in the broader sample

🔁 2+ Hour Daily Use: Deep Engagement Rises Sharply with Income

- Ad-Free CTV/OTT use climbs to 45% among very high-income homes — a significant rise from 31% across the total respondent base (Ad-supported CTV/OTT continues to hold its own with highest earning HH segment)

- Spotify and similar services surge to 48% at 2+ hours per day — more than double the level seen in the overall sample

- Podcasts reach 27% of $200K+ homes at 2+ hours, triple the share seen across the wider population

This level of sustained attention signals not just reach — but engagement, creating optimal moments for brand messaging to land with impact.

🧠 Traditional Media Still Has Pull in Affluent Households

- Cable and Local TV both see usage climb with income

- Local TV hits 43% (1+ hour) among $200K+ households, well above the 26% level seen among all survey participants

- AM/FM Radio — Talk and Music formats alike — gain traction, particularly in the very high-income group:

- Talk Radio (1+ hour): 39% among $200K+ vs. 21% among the total respondent group

- Music Radio: 48% among very high earners vs. 25% in the general population

- Even 2+ hour listening shows large gaps: Talk radio doubles, and music radio nearly triples, in the $200K+ group compared to typical respondents

Far from fading, these platforms are part of a rich, hybrid media diet that blends streaming convenience with trusted traditional channels.

💡 Takeaway for Brands and Advertisers

- Affluent households over-index in nearly every media category — especially digital streaming, audio, and on-demand content

- The opportunity compounds above the $200K threshold, where daily time spent increases dramatically across platforms

- Ad-supported CTV/OTT remains a strong and scalable channel — especially in the very high-income tier — even as ad-free options lead

- Streaming audio and podcasts offer breakout opportunities, with significant increases in daily listening as income rises

- Legacy media shouldn’t be overlooked, especially talk and music radio, which continue to perform well among affluent consumers

In the coming weeks, we’ll explore social media habits, ad attention & engagement, in-vehicle media consumption patterns and a variety of other ways advertisers and brands can reach and influence high and very-high income households through digital and traditional media

NuVoodoo conducts research and manages marketing campaigns for brands and advertisers. It’s easy to get in touch at tellmemore@nuvoodoo.com. We’d love to show you how we can be your valuable partner and add value to your next project.