New Data – Advertising Engagement & High Income Households

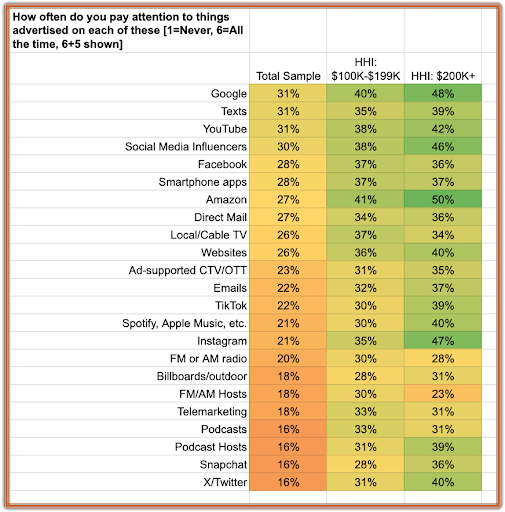

We’re spotlighting the media habits of higher-earning households, drawing from NuVoodoo’s latest national consumer study, where nearly one in five in our 2,908 respondent universe report household incomes above $100,000. In Part One, we explored how high-income ($100K–$199K) and very high-income ($200K+) households consistently outpace the broader population in daily media usage — with engagement climbing steadily alongside income. Now, in Part Two, we shift the focus to advertising: where these affluent audiences are most attentive, and what that means for brands. In a landscape crowded with media choices, this data offers a valuable roadmap for advertisers looking to invest their budgets with greater precision and impact.

📣 Ad Engagement Grows with Income — Especially at the Very Top

When asked study participants how often they pay attention to ads across various platforms, higher-income households consistently report greater engagement than the total sample — and that engagement climbs even further among the $200K+ HH tier. For advertisers, this means that affluent audiences aren’t just reachable — they’re receptive, often far more than the general public.

The chart below shows the percent of each segment who say they “often” or “always” pay attention to advertising (6+5 on a 1–6 scale).

📈 Why This Matters: High Earners Are More Tuned In Across Channels

-

The most affluent households aren’t ad-averse — they’re ad-selective. When ads are delivered via the right channels, especially digital-first platforms like Instagram, YouTube, or Spotify, attention spikes.

-

Audio, in particular, is a hidden gem. While the total sample shows low engagement with podcasts and streaming audio, $200K+ households are twice to nearly three times more likely to pay attention to ads in these spaces.

-

Retail platforms like Amazon and Google aren’t just search tools — they’re ad platforms with real traction among high-income users.

-

Social channels matter more at the top. Instagram, TikTok, and even X/Twitter see ad engagement skyrocket among the highest earners — a reminder that brand campaigns here can’t be one-size-fits-all.

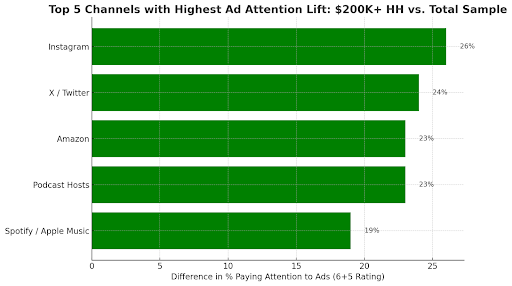

🔍 Where the Delta Is Greatest: Big Signals for Brands

Let’s look at some of the standout gaps between the $200K+ group and the total sample — where the signal-to-noise ratio is strongest for marketers.

🎯 Why These Channels Are Outperforming: Ad Attention Through the Lens of Affluent Households

When we isolate the platforms with the largest lift in ad attentiveness among $200K+ households — compared to the broader sample — a few expected leaders show up, alongside some surprises. What unites them isn’t just their reach, but their contextual power: the ability to deliver messaging in environments where affluent users are actively engaged, often with intent or trust.

📸 Instagram (+26% lift)

No surprise here. Instagram is a visually rich, shopping-friendly environment, and $200K+ households are more likely to act on what they see. From aspirational lifestyle content to highly personalized shopping ads, this platform seamlessly blends content with commerce — and affluent users are paying attention.

- Why it matters: These users have the discretionary income to act on inspiration fast — and the platform makes buying easy.

- Strategic insight: High earners don’t scroll passively here — they browse, discover, and shop.

🐦 X / Twitter (+24% lift)

This one may raise eyebrows. Many brands have backed off X due to brand safety concerns or its shifting tone under new leadership. But this data tells a different story: affluent consumers are still there — and still paying attention to ads.

- Why it matters: For some users, X remains a real-time source for niche communities (finance, tech, politics) where they’re deeply invested.

- Strategic insight: If your audience is highly engaged and income-qualified, this “no-go” platform might deserve a second look — with selective targeting.

🛍 Amazon (+23% lift)

Amazon is far more than a retail site — it’s a bottom-funnel ad platform with massive influence over high-income shopping behavior. The 23-point delta shows just how much more likely $200K+ households are to notice — and likely act on — what’s promoted there.

- Why it matters: Higher-income users may rely on Amazon for everyday convenience and luxury shopping — and are more open to discovery while browsing.

- Strategic insight: Ads on Amazon aren’t seen as interruptions — they’re seen as helpful suggestions.

🎙 Podcast Hosts (+23% lift)

The trust between podcast hosts and listeners has become a powerful performance channel, especially among the affluent — and it’s no coincidence this mirrors the high daily usage of podcasts we shared in part one of our series.

- Why it matters: These hosts act more like influencers than announcers, and affluent listeners view their endorsements as credible.

- Strategic insight: The host-read ad is today’s sponsored word-of-mouth — and it cuts through, particularly in longer-form, less distracted listening sessions.

🎧 Spotify / Apple Music (+19% lift)

Audio was one of the biggest surprises in this study. Despite assumptions that audio ads might be background noise, affluent households are significantly more likely to actually pay attention.

- Why it matters: Many in this group are daily streamers and treat audio as a primary medium — during workouts, commutes, or focused work time.

- Strategic insight: These listeners are more attentive than you might expect, especially when ads are relevant, targeted, and well-voiced.

Key Takeaways for Brands and Advertisers

For brands and advertisers the data reinforces a crucial truth: high-income households aren’t just more active media consumers — they’re more attentive to advertising across a broad mix of platforms. From retail giants like Amazon to influencer-driven channels like podcasts and Instagram, affluent audiences are tuned in and more likely to act. What’s especially powerful is the consistency of the trend — as income rises, so does responsiveness. This creates a strategic opportunity: rather than chasing broad reach alone, brands can target high-value segments where attention and intent align, and make smarter, more efficient use of their media budgets.

- Segment your media strategy by household income — the difference in ad responsiveness is too great to ignore.

- Don’t write off emerging or underperforming channels (like podcasts or X) in the general sample; among affluent households, these platforms are highly responsive.

- Meet them where they listen, shop, scroll, and stream — affluent consumers may be multitasking, but they’re also paying closer attention than the average viewer or listener.

In a fragmented media world, precision matters — and affluent consumers are clearly signaling where they can be reached. NuVoodoo helps clients optimize marketing decisions with custom research studies and tailored multi-media campaigns. Contact us at tellmemore@nuvoodoo.com for a complementary needs analysis conversation. We love a challenge and would welcome the opportunity to be a part of your team.