Moneyball: A New NuVoodoo Ratings Prospect Study

Just ahead of the holiday weekend we finished fielding on NuVoodoo Ratings Prospects Study 26. Two thousand adults 18-64 nationwide are included in the sample with the goal of helping programmers and managers make the best decisions possible as they head into the fall ratings that are about ten weeks away.

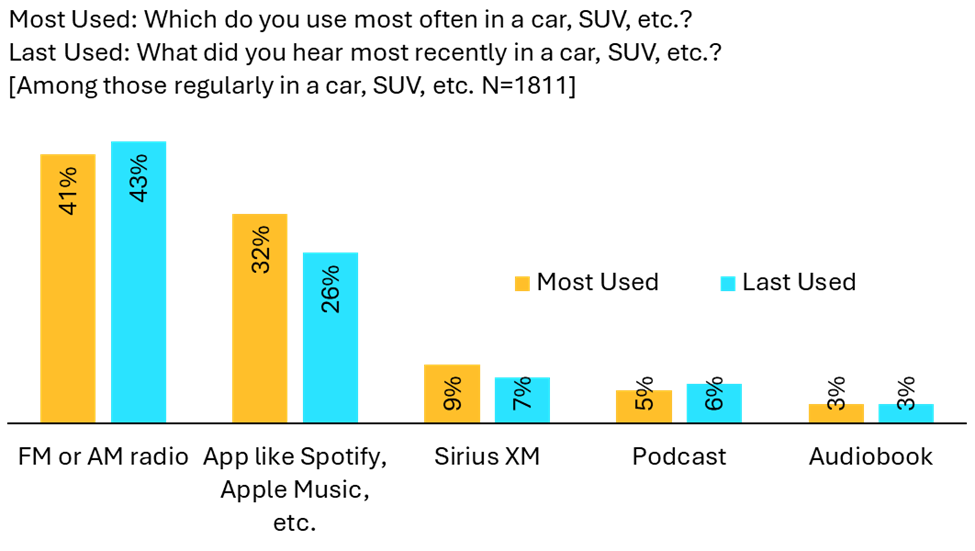

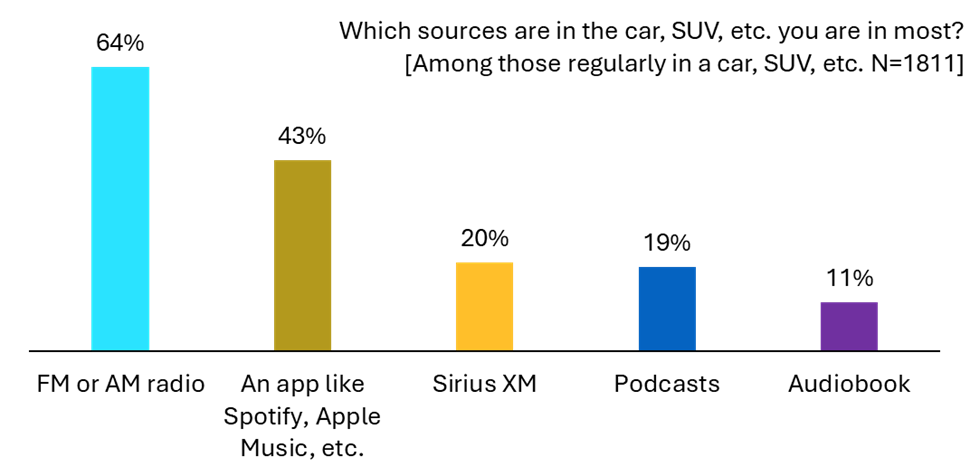

We smiled at the disparity between answers to questions about the source respondents say they use most often while in the car/SUV/etc. compared to what they say they heard most recently while in the car/SUV/etc. Apps like Spotify are reported as the source used most often by 32% of the roughly 1800 respondents who are regularly in a car, SUV, etc. as shown in the chart below.

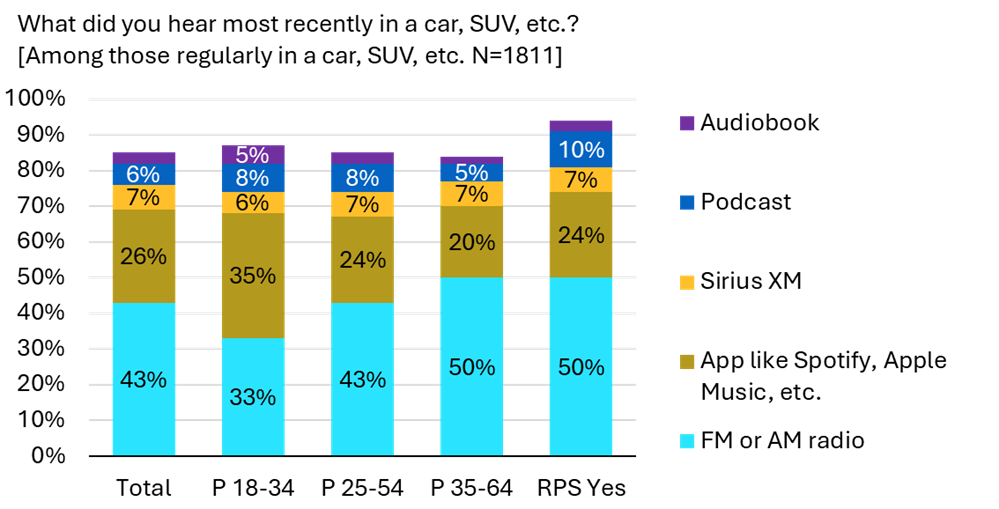

When pressed for what they heard most recently while on the road, apps like Spotify drop six points to 26% (SiriusXM drops 2 points), while radio rises to 43%. Some respondents see themselves as moving to streaming, but their reality seems to favor the simplicity and convenience of radio.

Importantly for radio, those most likely to participate in the ratings (labeled “RPS Yes” in the chart below) are 7 points more likely to cite that they most recently heard radio while on the road. The columns don’t go fully to 100% because some respondents say they don’t listen to anything while on the road – though fewer of the “RPS Yes” ratings say they don’t listen in the car/SUV/etc.

Radio no longer has the lock on in-vehicle listening it had in years gone by and 18-34s show less reliance on radio. Yet radio retains the ears of a healthy plurality overall and half of those likely to give the business its report card, giving us some runway to adjust. Best of all, radio remains on the in-vehicle menu for 64%, with a 21-point advantage over streaming apps.

Open-ended, we asked those who use radio while on the road, “What do you dislike about listening to FM or AM radio in the car?” Dislikes about radio in the car are overwhelmingly focused on a few core issues, primarily concerning content control and interruptions.

- Commercials/Advertisements: This is the most prevalent and strongest dislike, mentioned repeatedly in various forms (“ads,” “commercials,” “advertisements,” “too many ads,” “constant commercials,” “long advertising”). Respondents expressed frustration that ads “take up unnecessary time from the show,” “interrupt the songs,” and are often “boring” or “don’t apply to me.” The sheer volume and frequency of commercials are a major pain point, with many stating “too many commercials” or “commercials overwhelm the actual content.”

- Repetitive Music/Limited Variety: A very strong secondary theme is music repetition. Comments like “music is repeated over and over again,” “play the same songs over and over,” “repetitive playlists,” and “same hit daily” are common. Users dislike “limited song selection” or “limited amount of songs played.” The inability to “choose every song,” “control what song is going to play next,” or “skip songs you don’t like” contributes to this frustration. Some felt that “sometimes nothing good on” or “they don’t always play the music I want.”

- Excessive Talking (Non-Music Content): Many respondents expressed a desire for “more music and less commercials” and “less talking, more music.” Dislikes include “a lot of talking,” “too much talking about unimportant subjects,” and talk shows that “don’t stop talking.” Some dislike when morning show “hosts say things that are supposed to be funny but are actually mean.”

Next week, we’ll dive into the considerable list of advantages that came out when we asked respondents to tell us “what do you like about listening to FM or AM radio in the car?” If you’re worried about the outcome of the spring book, it’s a perfect time to review options for research. If you’re worried about maintaining momentum in the fall book, it’s a good time to look at the latest tools available for marketing. An email to leigh@nuvoodoo.com will get you a quick response.