More or Less? Looks Like It’s Both

The shelves weren’t – middle of the pandemic, no toilet paper in sight and Lysol rationing – empty. But over the last couple of months, we noticed some ‘holes’ – bare spots on shelves where our favorite brand, flavor, or scent would typically live. We saw car lots light on inventory and paid twice as much for a sheet of plywood – so we wondered, is everyone paying more and finding less? And more importantly, how are they managing? How are habits shifting to accommodate? We surveyed over 2,000 Americans aged 18 to 64 to determine which products they’ve noticed are more expensive, less available and how we’ve adjusted our shop.

NPR recently reported consumer prices in October 2021 were up 6.2% from a year ago (Department of Labor), marking the most significant YoY increase in more than 30 years. And news outlets from CNN and The New York Times to 60 Minutes continue to report on logistics and supply chain issues creating shopper frustration and empty shelves across the country.

Most of us have seen evidence of price and availability challenges, first-hand, in some form or another. (I bought a turkey and two jumbo packs of toilet paper two weeks ago, just in case!) But we wanted more than anecdotal stories – we wanted to put some figures behind what we’re all feeling! Our latest survey asked people what they’d noticed recently in price and availability across twenty-one different product categories. Then we took a deeper dive into their shopping habits to discover how they’re making things work to get the products they need.

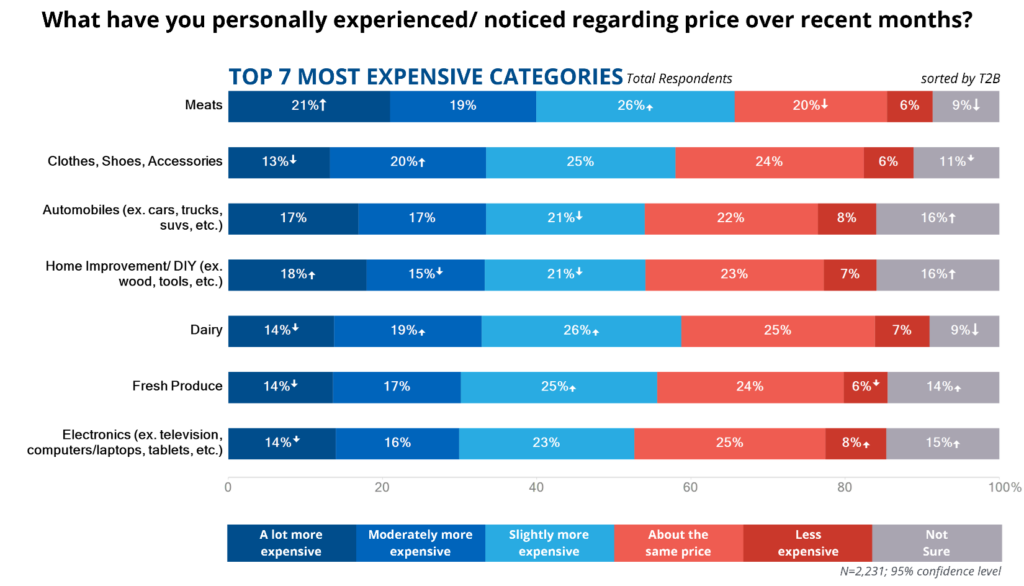

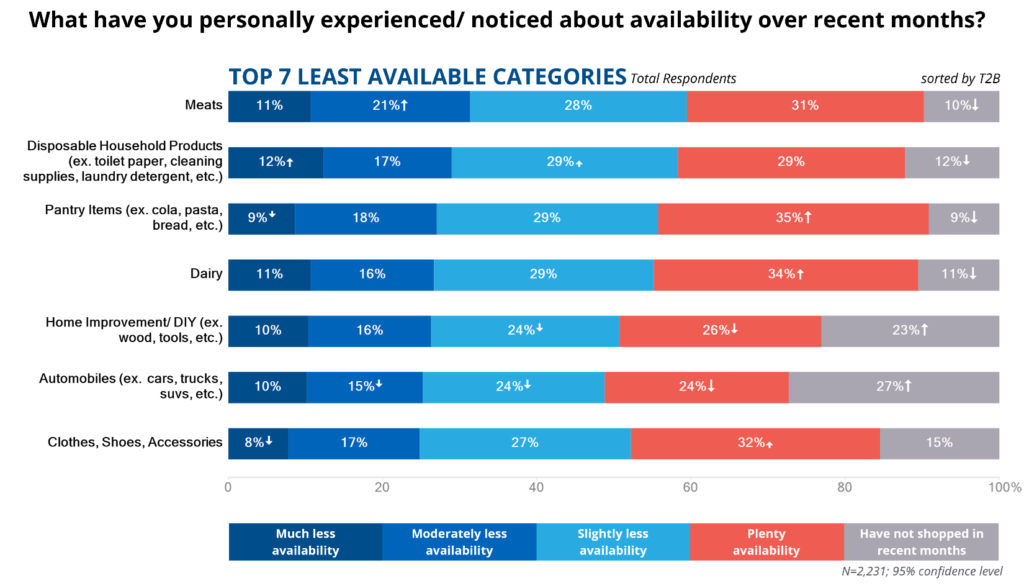

According to respondents, Meats, Dairy, Home Improvement/ DIY, Automobiles and Clothes, Shoes & Accessories are among the Most Expensive and Least Available products.

Forty percent of respondents report noticing Meats at least ‘moderately more expensive’ over recent months. And about 1/3 of respondents say they’ve seen Clothes, Shoes & Accessories, Automobiles, Home Improvement/ DIY Products and Dairy items have all been ‘moderately’ to ‘a lot’ more expensive in recent months. Fresh Produce and Electronics round out the top seven, with about thirty percent of respondents claiming these items have a higher sticker price. Of note, between 20% and 29% of respondents noticed at least moderately more expensive items in the remaining fourteen categories surveyed. It would seem very few of us have escaped paying more for at least something we needed lately.

When it comes to product shortages at-shelf, it’s a complicated series of unfortunate events that landed us here. And it doesn’t appear we’ll get relief anytime soon. A recent New York Times article (October 31, 2021) titled, How the Supply Chain Broke, and Why It Won’t Be Fixed Anytime Soon, shed light on the intricacies of our resource and product supply chain and the failings and challenges faced at every turn. And they report that when it comes to product shortages, “there are good reasons to suspect that this will be with us well into 2022 and maybe longer”.

No less than 20% of respondents report at least ‘moderately less availability’ across all twenty-one surveyed categories. About 30% of respondents say at least moderately less to choose from when shopping recently for Meats and Disposable Household Products like toilet paper, cleaning supplies and laundry detergent. About ¼ of respondents report ‘moderately to much less’ availability in the product categories: Pantry Items, Dairy, Home Improvement/ DIY, Automobiles and Clothes, Shoes and Accessories.

Knowing which categories people notice have fewer products and higher price points helps us better understand shopping stressors overall. But more importantly, we need to know how their shopping habits have changed, if at all, because of it. We estimated that a product would have to be at least moderately more expensive and/ or moderately more difficult to find for people to think about shopping alternatives.

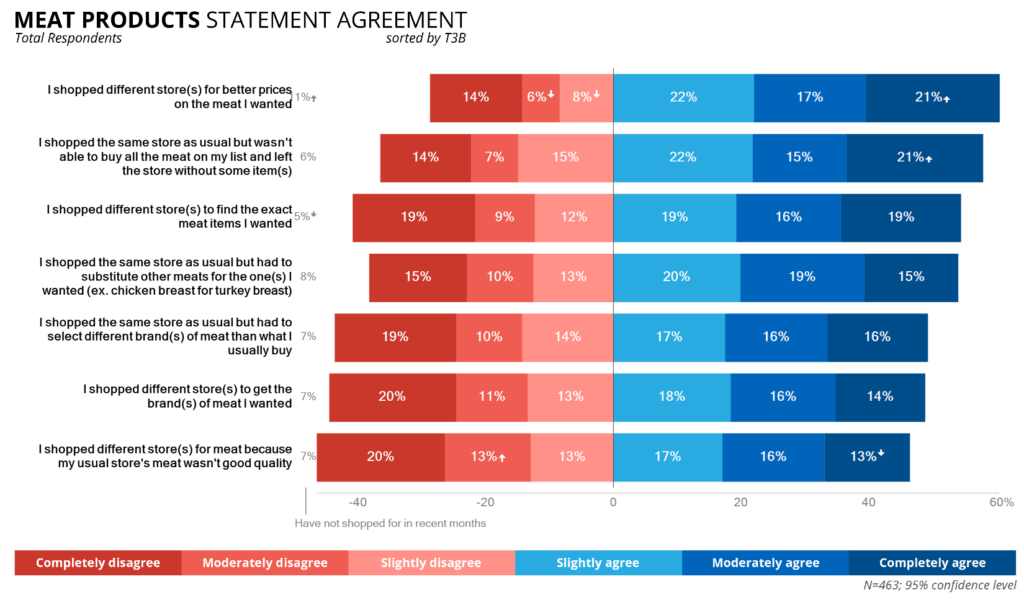

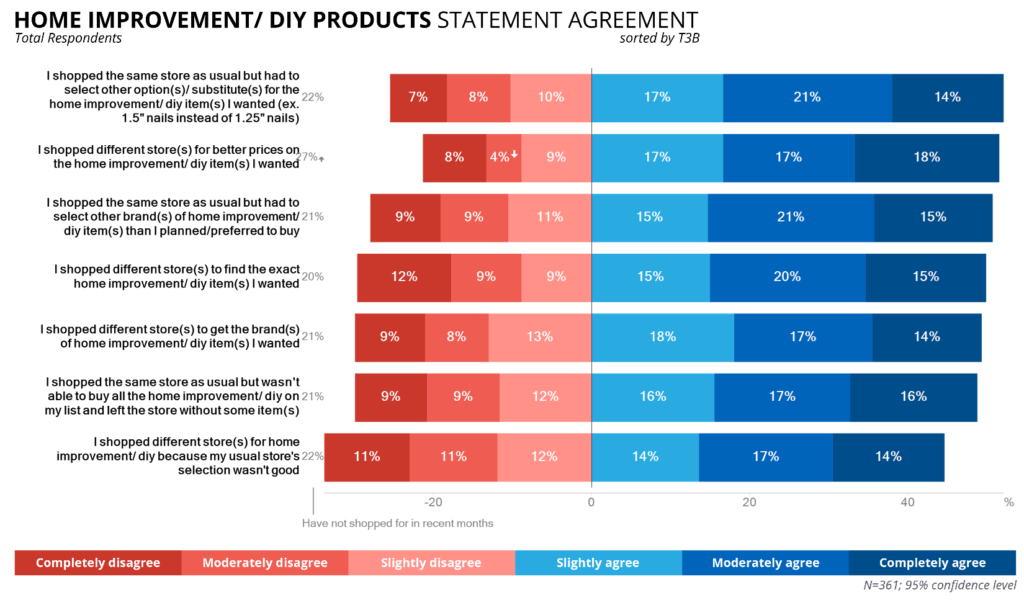

We asked respondents how much they agreed with a series of shopping habit statements for a few product categories where they noticed higher prices or less availability. We discovered subtle differences in consumer prioritization across product characteristics such as benefits/ features, brand and price point that may help companies and retailers implement tactics to maintain and grow their bottom line even in the toughest of times. To illustrate, we selected two product categories respondents reported among the top for higher prices and less availability.

First, let’s look at Meats. Respondents ‘Completely agree’ they shopped ‘different stores for better prices’ and ‘the same store but left without some item(s)’ at significantly higher rates than the other tested shopping alternatives when faced with higher prices and/ or less availability.

With the average price of ground beef around $4.72/lb in October 2021 (U.S. Bureau of Labor Statistics), it’s no surprise consumers are seeking out the best prices they can find. And with meat one of the highest-priced grocery items, even in normal times, it’s reasonable to suggest that a great sale on meat could drive retailer choice that week. That means the ‘not my usual’ store – with the better price on meat – wins the whole shopping list.

If meat prices drive retailer choice, a less popular store that chose to make a little less on meat could increase foot traffic, sell more of everything else and increase their bottom line overall. It may just be that to steal sales, try a meat sale.

Next, let’s take a look at the Home Improvement/ DIY category. Over 1/3 of respondents at least moderately agree they ‘shopped different store(s) for better prices on the home improvement/ DIY item(s)’ they wanted. Not surprising, given the top-selling categories at Home Depot and Lowe’s every year include appliances, tools, garden and other high-ticket items. The majority of consumers look for the best deal they can find, the more they spend.

But home improvement stores also sell loads of inexpensive items like nails, screws and paintbrushes – all with several possible substitutions at the ready. Over 1/3 of respondents ‘moderately’ or ‘completely’ agree they ‘shopped the same store as usual but had to select other option(s)/ substitution(s) for the home improvement/ DIY item(s)’ they wanted. It also seems loyalty to the retailer only slightly (but insignificantly) edged out brand loyalty. Which is more critical likely depends on the product(s) on the shopping list at the time. For instance, if you prefer Behr or Glidden paint – they’re exclusive to Home Depot. (Lowe’s has Valspar and Sherwin Williams.) But when it comes to grills, you can get a Weber at either.

For home improvement stores, exclusivity deals with top-performing brands ranked high in customer satisfaction can positively impact the bottom line. And keeping plenty of stock on-hand, plus comparable alternatives -and plenty associates around to suggest them- can keep customers from leaving empty-handed and maybe even for good.

If you’d like to learn more about how price and availability have impacted shopping for any category we surveyed, don’t hesitate to get in touch. Our data set includes everything from standard demographics like age, US Region and HHI to vaccination status, political affiliation and current living situation, along with our standard set of media usage questions. Whether your business depends on it, or you’re just curious – reach out today!

If you’d like to learn more about how price and availability have impacted shopping for any category we surveyed, don’t hesitate to get in touch. Our data set includes everything from standard demographics like age, US Region and HHI to vaccination status, political affiliation and current living situation, along with our standard set of media usage questions. Whether your business depends on it, or you’re just curious – reach out today!

The twenty-one categories we explored were: Meats, Disposable Household Products, Pantry Items, Dairy, Home Improvement/ DIY, Automobiles, Clothes, Shoes & Accessories, Canned Goods, Frozen Foods, Large Appliances, Electronics, Fresh Produce, Entertainment, Small Appliances, Health, Personal Care & Beauty, Furniture, Fine Jewelry, Gardening/ Lawn Care, Exercise/ Wellness, Home Décor and Other Vehicles (ex. motorhomes, four-wheelers, motorcycles, etc.

Our ‘In the kNOW’ series tackles the burning questions we all want to know about right NOW. If you have questions you think we should ask, topics we should explore, things you’d like to learn more about, shoot me a note at tellmemore@nuvoodoo.com.